The global financial system is undergoing a transformation that is more rapid and far-reaching than anything seen before. At the center of this revolution lies the fusion of artificial intelligence (AI) and financial technology (fintech). What began as simple online banking and payment apps has evolved into a dynamic ecosystem driven by machine learning, data analytics, and automation.

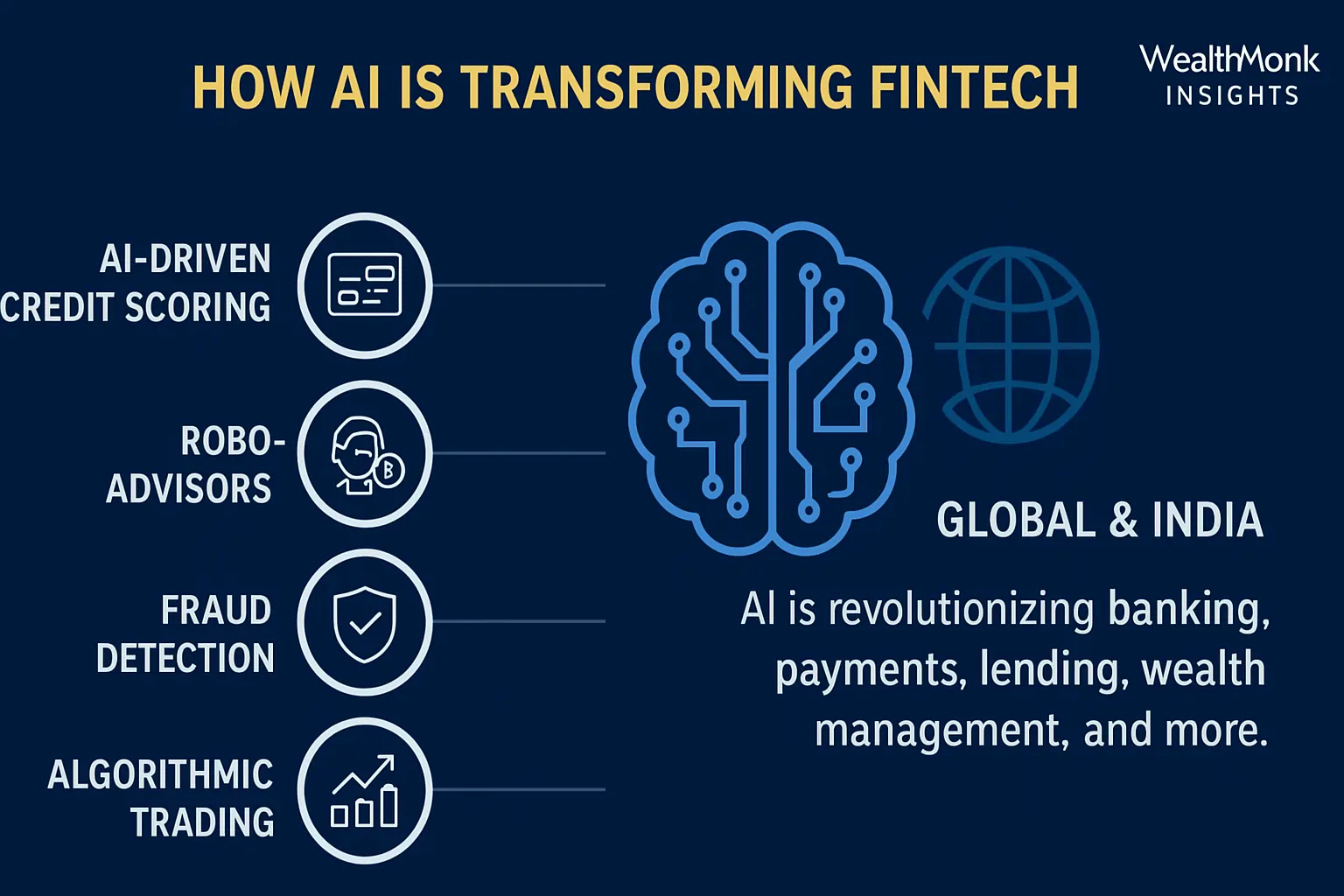

From AI-driven credit scoring to robo-advisors, fraud detection, and algorithmic trading, technology is rewriting the rules of finance. For investors, entrepreneurs, and professionals, understanding how AI and fintech are reshaping global markets is not just important; it is essential for survival in the digital age.

In this article, we explore the evolution, real-world case studies, and the future of AI in fintech. We also look at how Indian and global companies are using AI to redefine financial inclusion, risk management, and investing behavior.

1. The Rise of AI in Fintech: A Global Overview

Fintech has become one of the fastest-growing sectors worldwide. In 2025, the global fintech market is projected to surpass USD 400 billion, and AI will power nearly half of this growth.

The reasons are clear:

- The financial world generates massive amounts of data every second.

- Consumers expect instant, personalized, and seamless financial services.

- Banks and startups need to reduce costs, fraud, and risk while improving efficiency.

AI bridges these needs perfectly. By combining predictive analytics, natural language processing (NLP), and automation, financial institutions can make data-driven decisions at lightning speed.

Key AI Applications in Fintech

- Credit Scoring and Risk Analysis: AI models evaluate non-traditional data like spending behavior, education, and employment to assess borrower risk.

- Fraud Detection: Machine learning algorithms analyze millions of transactions in real-time to identify unusual patterns.

- Algorithmic Trading: AI systems predict market movements and automate trades with unmatched precision.

- Wealth Management: Robo-advisors provide personalized investment strategies for retail and high-net-worth clients.

- Customer Support: AI-powered chatbots and voice assistants improve client engagement and service delivery.

2. AI in the Indian Fintech Ecosystem

India has emerged as a global fintech powerhouse, ranking third in the world by the number of fintech startups. The country’s young population, digital infrastructure, and government initiatives such as Digital India and UPI have created the perfect foundation for AI adoption in finance.

AI-Powered Credit and Lending

Companies like Paytm, Lendingkart, and KreditBee use machine learning models for real-time lending decisions.

Instead of relying solely on CIBIL scores, these platforms analyze behavioral data, transaction histories, and even mobile usage to determine creditworthiness.

This approach has enabled financial inclusion for millions of Indians who were previously “credit invisible.”

AI in WealthTech and Retail Investing

Platforms such as Zerodha, Groww, and Smallcase employ data intelligence and predictive analytics to help retail investors make informed decisions.

AI-driven recommendation systems suggest investment portfolios based on users’ risk tolerance, past behavior, and market conditions.

RegTech and Fraud Detection

Regulatory technology, or RegTech, is another fast-growing AI segment. Indian regulators like RBI and NPCI are exploring AI tools for fraud prevention, AML (Anti-Money Laundering) monitoring, and real-time transaction tracking.

3. Global Innovations in AI and Fintech

While India has made significant progress, global leaders like the US, China, and Singapore continue to push the boundaries of AI integration.

JPMorgan Chase – AI in Fraud Detection and Trading

JPMorgan’s “COIN” platform processes legal documents using natural language processing, saving over 360,000 hours of manual review annually.

The bank also employs AI-driven trading algorithms that analyze massive datasets to identify profitable patterns and minimize risk.

Ant Group (China) – AI for Scalable Finance

Ant Group’s Alipay ecosystem integrates AI across payments, credit scoring, and customer support. Their Zhima Credit system evaluates billions of transactions daily to assess financial reliability.

AI also powers fraud detection systems capable of identifying irregularities within seconds, ensuring trust at scale.

Upstart (USA) – Machine Learning for Lending

Upstart uses AI to evaluate loan applications based on non-traditional data, such as education, job history, and spending behavior.

The result: 75% fewer defaults and faster loan approvals, demonstrating how AI enhances both accuracy and inclusion in financial lending.

4. The Role of AI in Key Financial Segments

A. Banking

Banks worldwide are using AI to automate back-office operations, improve customer support, and detect financial crimes.

Chatbots, such as HDFC’s “EVA,” respond to millions of queries daily, while fraud detection systems monitor suspicious patterns in real time.

B. Investment and Trading

AI-driven trading platforms analyze huge volumes of market data to generate buy/sell signals. Algorithmic trading now accounts for more than 70% of global equity trading volume.

Platforms like QuantConnect and Numerai allow investors to leverage AI-based strategies, democratizing access to quantitative trading tools once reserved for large institutions.

C. Insurance (InsurTech)

AI algorithms are being used to assess risk profiles, detect fraudulent claims, and streamline policy underwriting.

For instance, Policybazaar uses AI to match customers with suitable policies based on their behavior and financial goals.

D. Personal Finance and Advisory

AI-driven robo-advisors such as INDmoney, Wealthfront, and Betterment automate portfolio management. They use data analytics to rebalance investments and optimize returns based on market fluctuations.

5. Data, Security, and Ethics: Challenges of AI in Finance

While AI offers tremendous benefits, it also brings challenges that cannot be ignored.

Data Privacy and Security

The backbone of AI in fintech is data. However, sensitive financial data must be protected from misuse or breaches.

With the rise of cyber threats and deepfakes, data security and encryption are now more critical than ever.

Algorithmic Bias

AI models are only as fair as the data they are trained on. If datasets contain bias, decisions such as credit scoring or loan approvals can unintentionally discriminate against certain groups.

Regulatory Concerns

As AI-driven finance grows, so does the need for transparent regulation. Authorities like RBI, SEBI, and FATF are working to develop frameworks that ensure accountability, fairness, and explainability in AI systems.

6. The Future of AI in Global Finance

The next decade will redefine how money moves, how investments are made, and how institutions operate. Here are the most significant trends shaping the future:

1. Embedded Finance

AI will integrate financial services directly into non-financial platforms, such as e-commerce and travel apps, allowing users to access loans or insurance instantly.

2. Generative AI in Advisory

ChatGPT-like models will become financial advisors, providing hyper-personalized recommendations based on user goals, market trends, and behavioral data.

3. Predictive Banking

Banks will shift from reactive to predictive models. AI will forecast financial needs and offer preemptive solutions, such as automatic savings or investment suggestions.

4. Blockchain and AI Convergence

The combination of blockchain’s transparency and AI’s intelligence will create a new era of trust-based financial systems. Smart contracts will execute automatically when predefined conditions are met.

5. Hyperpersonalization

AI will allow institutions to customize every aspect of customer experience, from pricing and offers to communication and investment strategy, based on individual profiles.

7. WealthMonk Insights: What It Means for Investors and Businesses

For Retail Investors:

AI is your ally in smarter investing. Tools powered by machine learning can help identify undervalued stocks, manage risk, and automate portfolios with minimal human bias.

For Startups and Fintech Entrepreneurs:

Integrating AI into product design isn’t optional anymore. It’s the foundation for personalization, predictive analytics, and competitive differentiation.

For Financial Professionals:

AI will not replace financial advisors but will enhance their capabilities. Those who adapt early will be better positioned to offer value-driven, data-backed advice.

For Regulators and Policymakers:

Balancing innovation and oversight is key. Ethical AI frameworks will determine how smoothly fintech integrates into the formal financial system.

Conclusion

AI and fintech together are reshaping the financial landscape at an unprecedented pace. The convergence of these technologies is making finance faster, smarter, and more inclusive, empowering both institutions and individuals.

In India, AI-driven fintech has already expanded access to credit, streamlined investing, and enhanced digital payments. Globally, financial giants are using AI to drive efficiency, reduce risk, and create more personalized financial experiences.

However, as the technology evolves, so must our approach to data ethics, regulation, and transparency. The institutions that strike the right balance between innovation and responsibility will define the future of global finance.

At WealthMonk Insights, we believe the integration of AI in fintech is not just a trend; it is the foundation of a smarter financial future.